The two most confused phrases among first time employees are gross pay versus net pay. The simple way to remember the difference between these two is that gross pay is what you earned before taxes have been deducted. While net pay is what remains after taxes are deducted. Read more about the law with regards to minimum wage and the FLSA regulations.

Tracking Net Pay

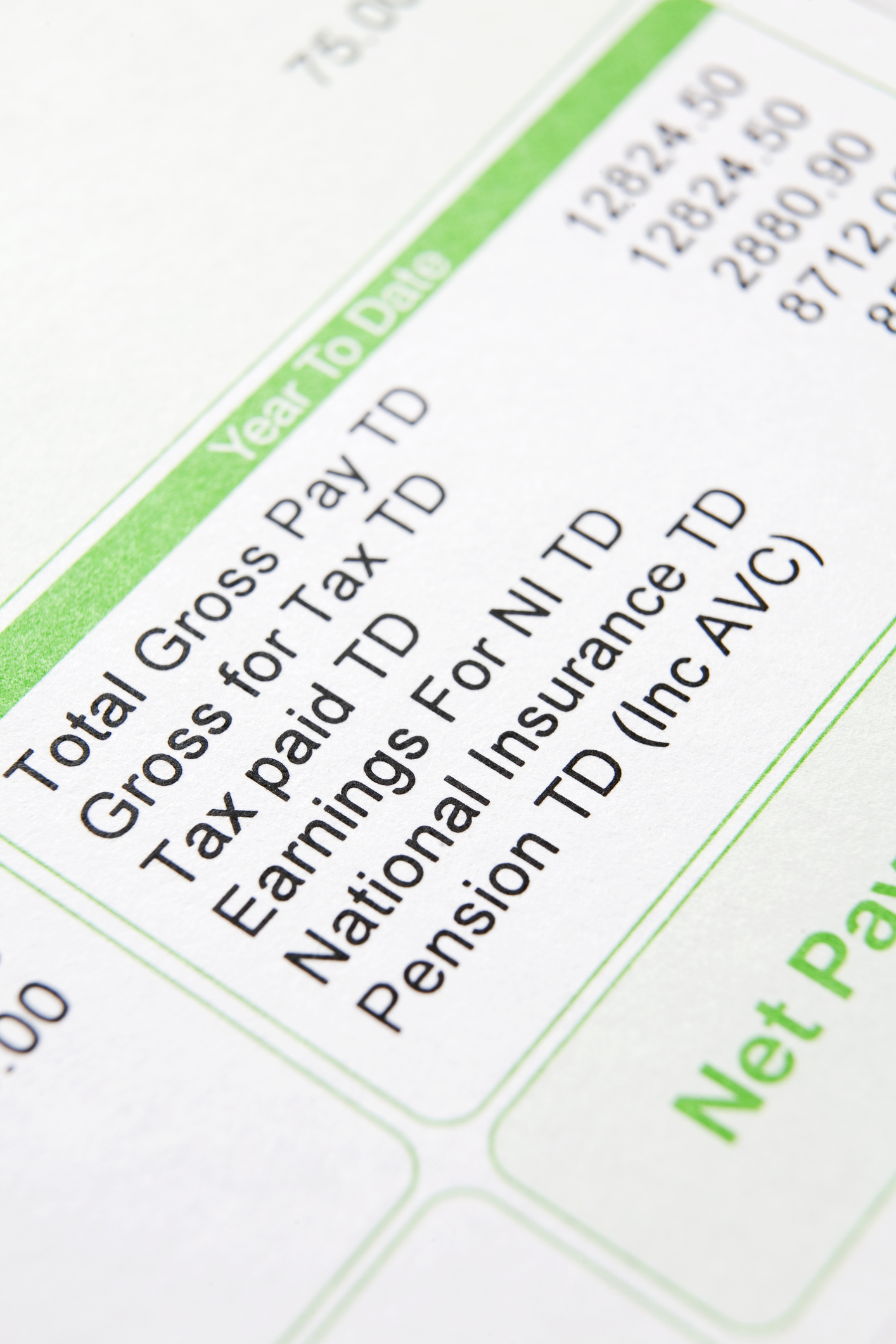

Net pay is important to track from one pay period to another. If wages are directly deposited to your bank account, you will receive a payroll voucher. This will list all of the taxes deducted from your gross pay.

The voucher usually includes a copy of a payroll check with the words, “Non Negotiable” stamped on the authorized signature line where your employer normally signs your check.

The reason it is important to track your net pay is so you can verify all deductions are accurate. Please note those that change during the course of your employment year. The amount of your paycheck after taxes depends on the gross amount paid to you by your employer.

Know Your Payroll Tax Deductions

In order to know what your take home pay will be, you need to know which payroll taxes have been deducted. and what the amounts of these deductions are. These include:

- Social Security

- Medicare

- Federal Withholding

- State taxes like state unemployment, state income taxes & state Medicaid

All deductions are found on your payroll voucher as year-to-date (YTD) and current pay period deductions. This is along with current deductions and total amount YTD.

Rate of Taxation

The Internal Revenue Service (IRS) designates each employee’s wages in income tax brackets. To know what your paycheck after taxes will be, you need to know what your particular income tax bracket is for the year in which you are paid.

Note that these brackets change from year to year due to inflation adjustments.

Ref: http://www.investopedia.com/terms/t/taxbracket.asp

When you were hired, you filed a W4 form provided by your employer so he could withhold current, correct payroll tax deductions from your wages. When you filed the W4, you listed your tax status as single, married with or without dependents. This is a factor in what your taxable income is and what your take home pay will be.

Example: Employees who file as single and earn less than $9,325 annually are taxed at 10 percent income tax bracket rate for 2017. The average for those earning wages of more than $9,325 and up to $37,950 for 2017 would be at 15 percent and $37,950 and $91,900 wages are taxed at 25%. As annual income increases, taxable income amounts also increase. In the U.S., tax brackets range from 10 percent up to 39.6% for those earning over $418,000. Ref: https://www.efile.com/tax-service/tax-calculator/tax-brackets/

Average Tax Rates on Taxable Income

In the U.S., you may likely fall into the average tax rate category. According to the IRS, employees pay an average tax rate of 31.5 percent on their wages.

To configure your take home pay, find your annual rate of income and the tax bracket into which your income falls on a federal and state level. This allows you to have a clearer picture of your paycheck after taxes. If your annual income before taxes is $80,000 and your tax bracket is 25%, you can configure what your net income will be. The best way to ensure you receive the wages you earned is to make sure you know how your wages are taxed. Find out the best time tracking app to maintain productivity.